missouri vendor no tax due certificate

Missouri Find out what constitutes sales tax nexus in Missouri here. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Delaware Sales Tax Exemption Form to buy these goods tax-free.

Other registration requirements may apply.

. 20 seats 2 bathrooms. Exempt if no expiration date Credit Memos. Vendors Use Tax Return and Instructions - For Reporting Periods Beginning January 2011.

Nebraska Nebraska Revised Statute 77-270113 defines what business activities create sales tax nexus in Nebraska. Nevada Nevada defines what creates sales tax nexus in the state in a Sales Tax FAQ. To get a resale certificate in Arizona you may complete the Arizona Resale Certificate Form 5000A the Multistate Tax Commissions Uniform Sales and Use Tax Certificate or the Border States Uniform Sale for Resale Certificate Form 60-0081.

However a business making retail sales in Missouri must post a bond equal to two times the average monthly sales and use tax. Its free to register for a Nebraska sales tax. Therefore you can complete the ST-4 sales tax resale certificate form by providing your Massachusetts Sales Tax Number.

The card is valid until the expiration date of the State Certification. 93-5 November 10 1 993 and Tax Information Release No. Theres no state sales tax in Montana.

5 3 years if result of a retail business transaction. Missouri Department of Agriculture. Counties and cities can charge an additional local sales tax of up to 15 for a maximum possible combined sales tax of 75.

The sales tax number and resale certificate are commonly thought of as the same thing but they are actually two separate documents. Certificate of Workers Compensation Insurance required for any type of contractor as required by State Law or an Affidavit of Exemption of Workers Compensation. For additional information about proper issuance and use of this certificate please review Reg-1-013 Sale for Resale Resale Certificate and Reg-1-014 Exempt Sale Certificate.

Complete and pass the exam to earn the Fort Worth Food Manager Certificate. The sales tax number allows a business to sell and collect sales tax from taxable products and services in the state while the resale certificate allows the retailer to make tax-exempt purchases for products they intend to. Certificates of Insurance must name the City of Lees Summit Missouri as.

Contractors complete Form 13 Section C part 1 or part 2 based on the option elected on the Contractor Registration Database. Interestingly Nevada repealed their definition of retailer. Taxes not paid in full on or before December 31 will accrue penalties and.

If a tax bill is not received by the second week in December contact the collectors office at 573 886-4285. Present a copy of this certificate to suppliers when you wish to purchase items for resale. Florida has 993 special sales tax jurisdictions with local sales taxes in.

Or no tax does not in fact apply to the sale the purchaser is liable to pay the seller the additional tax imposed. Delaware Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Delaware sales tax only applies to end consumers of the product. Smith comes in to apply for a Missouri Tax ID.

Obtain a Massachusetts Sales Use Tax Certificate. The Department of Agricultures mission is to serve promote and protect the agricultural producers processors and consumers of Missouris food fuel and fiber products. Jones for a Certificate of No Tax Due.

View a variety of Missouri business opportunities from small home-based businesses to established high cash flow businesses and find the right business for sale in Missouri today. The collectors office mails tax bills during November. If you already have a food manager certificate.

State of Missouri No Tax Due Certificate if retail sales Additional Documentation for Contractors. No Tax Due Request. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

Its free to register for a Missouri sales tax license. Retail Sales Tax License cannot be issued without a taxable begin date. Refer to State law for specific information.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Mark Faggiano is the founder and CEO of TaxJar a service built to make post-transaction sales tax compliance easier for Etsy Amazon Shopify and other multi-channel ecommerce sellers. Marks passion is solving complex problems for.

Missouri Tax Registration Application Small Businesses NOTE. Rent is 1400 plus insurance property tax 56638 so total is 196638. Groceries and prescription drugs are exempt from the Florida sales tax.

A claim for fifty percent of the credit shall be allowed when the child is placed in the home. Fill out the ST-4 sales tax resale certificate form. 98-8 October 30 1998.

If you are a seasonal business check the months in which you. Companies or individuals who wish to make a qualifying. 9613 Missouri Special Needs Adoption Tax Credit Individuals and business entities may claim a tax credit for their total nonrecurring adoption expenses in each year that the expenses are incurred.

Once eBay has processed the certificate then they will no longer charge the buyer tax on their eBay purchases. Still have 5 years lease term remaining. Of Taxation Tax Information Release No.

3 60 if certificate has expiration date. 03 Section 6651 imposes an addition to tax for failure to pay if a taxpayer does not make a timely FTP unless such failure is due to reasonable cause and not due to willful. Nexus with Missouri the vendor is required to collect and remit Missouri vendors use tax.

Bring your state-approved certificate and 15 to Consumer Health 818 Missouri Ave. 02 Section 6655 imposes an addition to tax for underpayments of estimated tax by a corporation private foundation tax-exempt organization or qualified settlement fund. Stats wales council tax.

Request for Substitute Forms Approval. You may use an out-of-state sales tax license number to fill out these forms.

Move In Move Out Checklist For Landlord Tenant Eforms Free Fillable Forms Move In Checklist Being A Landlord Landlord Tenant

Motivational Quotes Motivation Motivational Quotes Business Quotes

Move In Move Out Checklist For Landlord Tenant Eforms Free Fillable Forms Move In Checklist Being A Landlord Landlord Tenant

Covid Vaccination Card Fraud Prompts Cdc Action

U S Sales Tax Explained For Both U S And Non U S Sellers Sellics

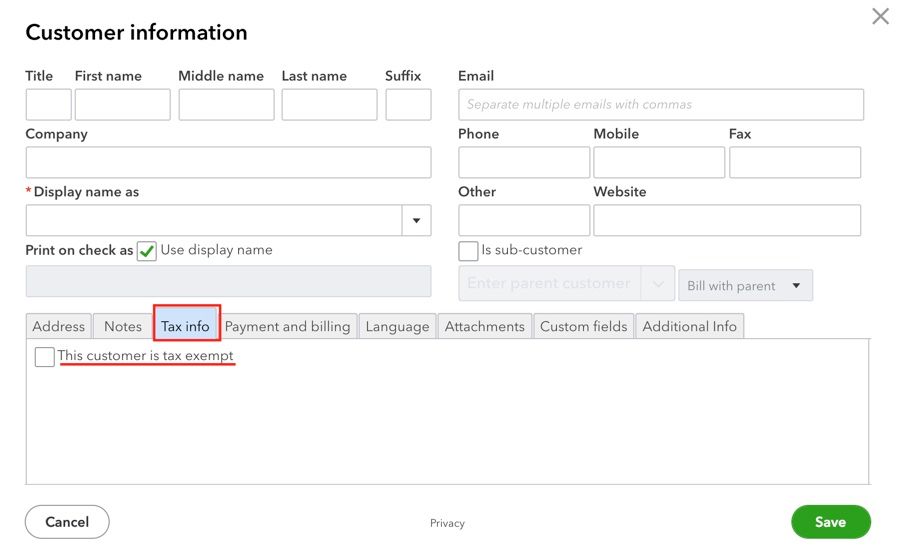

Setting Up Sales Tax In Quickbooks Online

Missouri No Tax Due Statements Available Online